Investment and Residential

Empower Your Dreams with Easy Financing

Quick, Reliable, and Flexible Loans Tailored to Your Needs

900M+

Funded by iCore Lending Inc

6 years

Industry experience

Why Choose Us

Building Trust with Innovative Lending Solutions for Financial Success

Our experienced professionals craft personalized lending strategies to meet your financial aspirations. We emphasize transparency, reliability, and tailored solutions to ensure a seamless journey toward achieving your goals.

Trusted Expertise

Our team of seasoned lending specialists ensures a smooth, efficient process by offering expert guidance tailored to your financial needs.

Cash Flow Optimization

Streamline your cash flow with structured lending strategies and effective financial planning, ensuring long-term stability and growth.

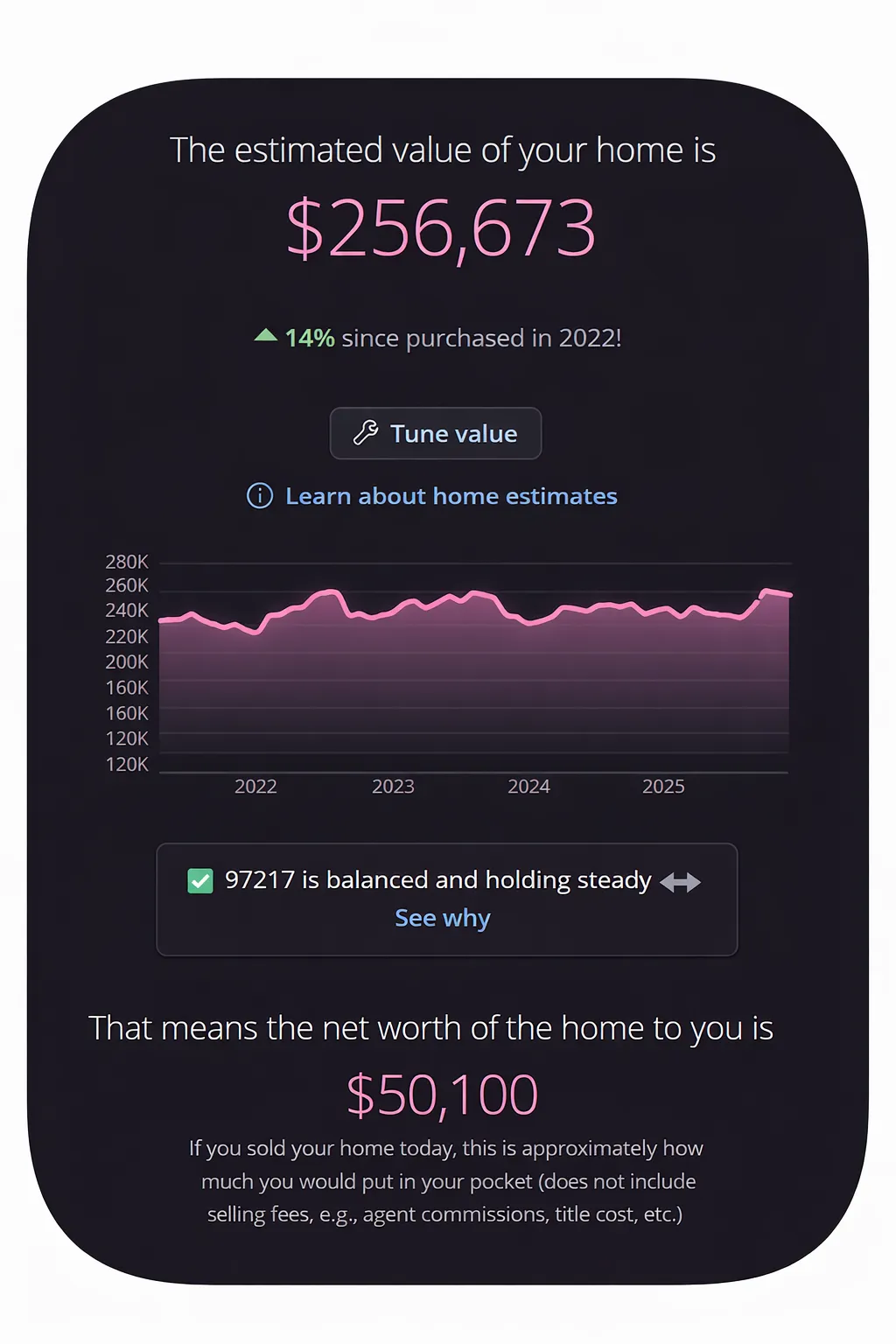

Portfolio Monitoring

Stay on top of your property financial goals with proactive reporting, recent sales data and access to other tools.

Want to get in Touch?

Fill out the form below and we will reach out as soon as we can.

Quick Links

Contact Us

Legal

iCore Lending, Inc NMLS #1547623, California DFPI Finance Lenders Law License #60DBO-79265, California Real Estate Corporation DRE License Endorsement #02019879, Arizona Mortgage Banker License #1028700, Florida Mortgage Lender Servicer License #MLD2097

Oregon “Licensed by the Oregon Division of Financial Regulation of the Department of Consumer and Business Services. For consumer complaints, call us at 888-877-4894 or go to dfr.oregon.gov.” The posting of this notice complies with the requirements of ORS 725.160, 725A.032, 86A166, and 86A.309.Consumer Access Site.

©2021 “CONSUMERS WISHING TO FILE A COMPLAINT AGAINST A MORTGAGE BANKER OR A LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATOR SHOULD COMPLETE AND SEND A COMPLAINT FORM TO THE TEXAS DEPARTMENT OF SAVINGS AND MORTGAGE LENDING, 2601 NORTH LAMAR, SUITE 201, AUSTIN, TEXAS 78705. COMPLAINT FORMS AND INSTRUCTIONS MAY BE OBTAINED FROM THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV. A TOLL-FREE CONSUMER HOTLINE IS AVAILABLE AT 1-877-276-5550. THE DEPARTMENT MAINTAINS A RECOVERY FUND TO MAKE PAYMENTS OF CERTAIN ACTUAL OUT OF POCKET DAMAGES SUSTAINED BY BORROWERS CAUSED BY ACTS OF LICENSED MORTGAGE BANKER RESIDENTIAL MORTGAGE LOAN ORIGINATORS. A WRITTEN APPLICATION FOR REIMBURSEMENT FROM THE RECOVERY FUND MUST BE FILED WITH AND INVESTIGATED BY THE DEPARTMENT PRIOR TO THE PAYMENT OF A CLAIM. FOR MORE INFORMATION ABOUT THE RECOVERY FUND, PLEASE CONSULT THE DEPARTMENT’S WEBSITE AT WWW.SML.TEXAS.GOV.”